The AI Fraud Revolution: How Emerging Tech is Making Deception Easier

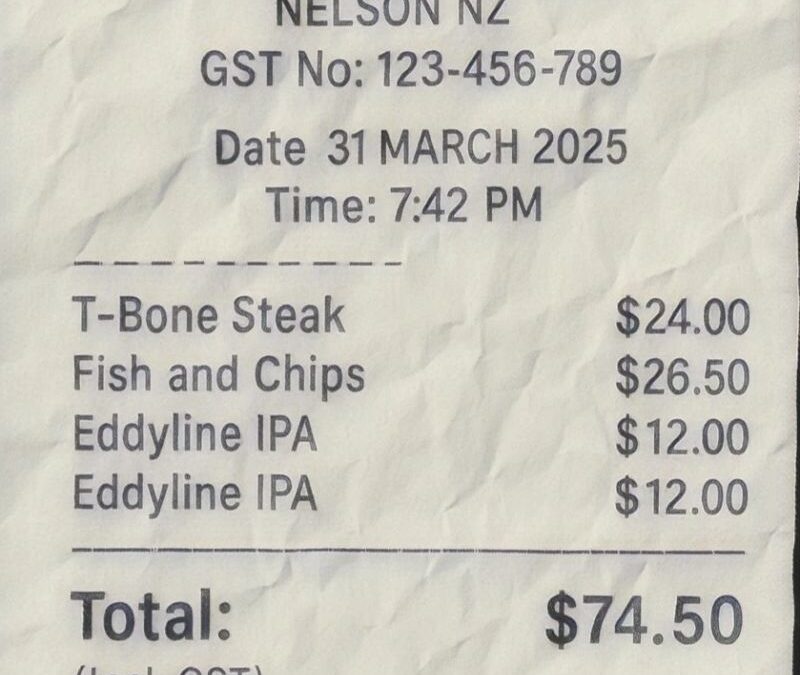

Imagine submitting an expense report with a completely fabricated restaurant receipt—complete with a business name, street address, date, and itemized charges. Now, imagine that receipt was generated in seconds using AI. No Photoshop, no design skills—just a simple request to an AI tool, which even crumpled the receipt slightly to make it look more realistic.

This isn’t science fiction. It’s happening right now. AI-powered tools are making fraud easier than ever, raising serious concerns for businesses, financial institutions, and regulatory bodies worldwide.

The Rising Threat of AI-Generated Fraud

In a world where AI can generate hyper-realistic invoices, contracts, and even deepfake videos, traditional fraud detection methods are becoming obsolete. Expense fraud is just one example—imagine the broader implications for financial fraud, tax evasion, and identity theft.

Many businesses rely on automated expense management systems to process receipts. But these systems, designed to detect human-made errors, struggle against AI-generated fraud, which can be nearly indistinguishable from authentic documentation. As a result, organizations risk reimbursing fake expenses, approving fraudulent transactions, or even making business decisions based on manipulated data.

Why Traditional Fraud Detection Falls Short

Most fraud detection methods rely on manual verification, paper trails, and basic pattern recognition. These approaches, while effective against human deception, are inadequate in the face of AI-generated forgeries. Fraudsters are no longer just manipulating existing documents—they’re generating entirely new ones that evade conventional scrutiny.

The Future of Fraud Prevention: AI vs. AI

To combat AI-driven fraud, businesses must adopt equally sophisticated security measures. Here are four key strategies for staying ahead:

- Enhanced Digital Forensics – Just as AI can create fraud, it can also detect it. AI-driven forensic tools can analyze patterns, metadata, and inconsistencies in digital documents to flag potential fraud.

- Blockchain for Verification – Blockchain technology provides immutable, timestamped records for transactions, making it nearly impossible to alter financial records or fabricate documents without detection.

- Stronger Authentication – Multi-layered verification, including biometric authentication and AI-assisted document verification, can make it significantly harder for fraudulent documents to pass undetected.

- Human-AI Collaboration – While AI plays a crucial role in detecting fraud, human oversight remains essential. Training professionals to recognize AI-generated fraud and implementing human-in-the-loop verification processes can enhance security.

The Race to Adapt

As AI capabilities continue to evolve, so must our security measures. The question isn’t whether fraud methods will change—it’s how quickly businesses will adapt to counteract them. Organizations that fail to update their fraud prevention strategies risk financial losses, reputational damage, and regulatory penalties.

The AI revolution is here. The key to staying secure isn’t resisting change—it’s embracing AI-driven defenses to combat AI-driven threats.